Maryland Economic Impact Study by Gerald Friedman, Ph.D.

July 22, 2012

The following is the executive summary of the economic impact study of the proposed Maryland Health Security Act. You can download the full study here.

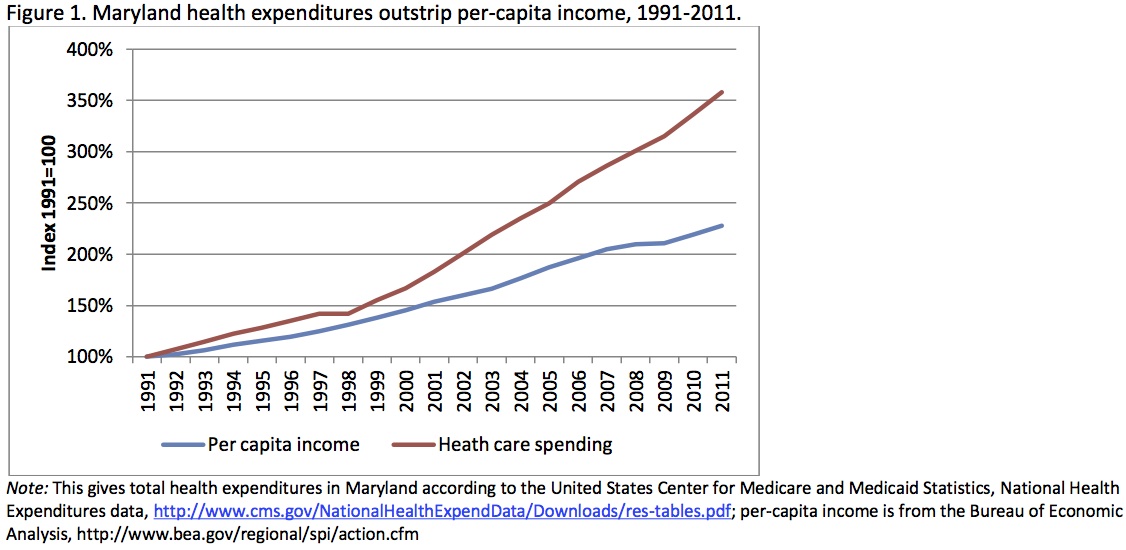

Maryland is on an unsustainable economic path; health care costs are absorbing a growing share of personal income. Between 1991 and 2011, health care spending in Maryland increased by $35 billion, nearly 10-times the rate of population growth and almost twice the rate of growth in per-capita income. Should health care spending continue to increase at this rate, spending will pass $100 billion in a little over a decade. Little of this increased spending can be attributed to improvements in health care; instead, the fastest growth has been in administration and billing operations while many remain without adequate health insurance or access to needed care.

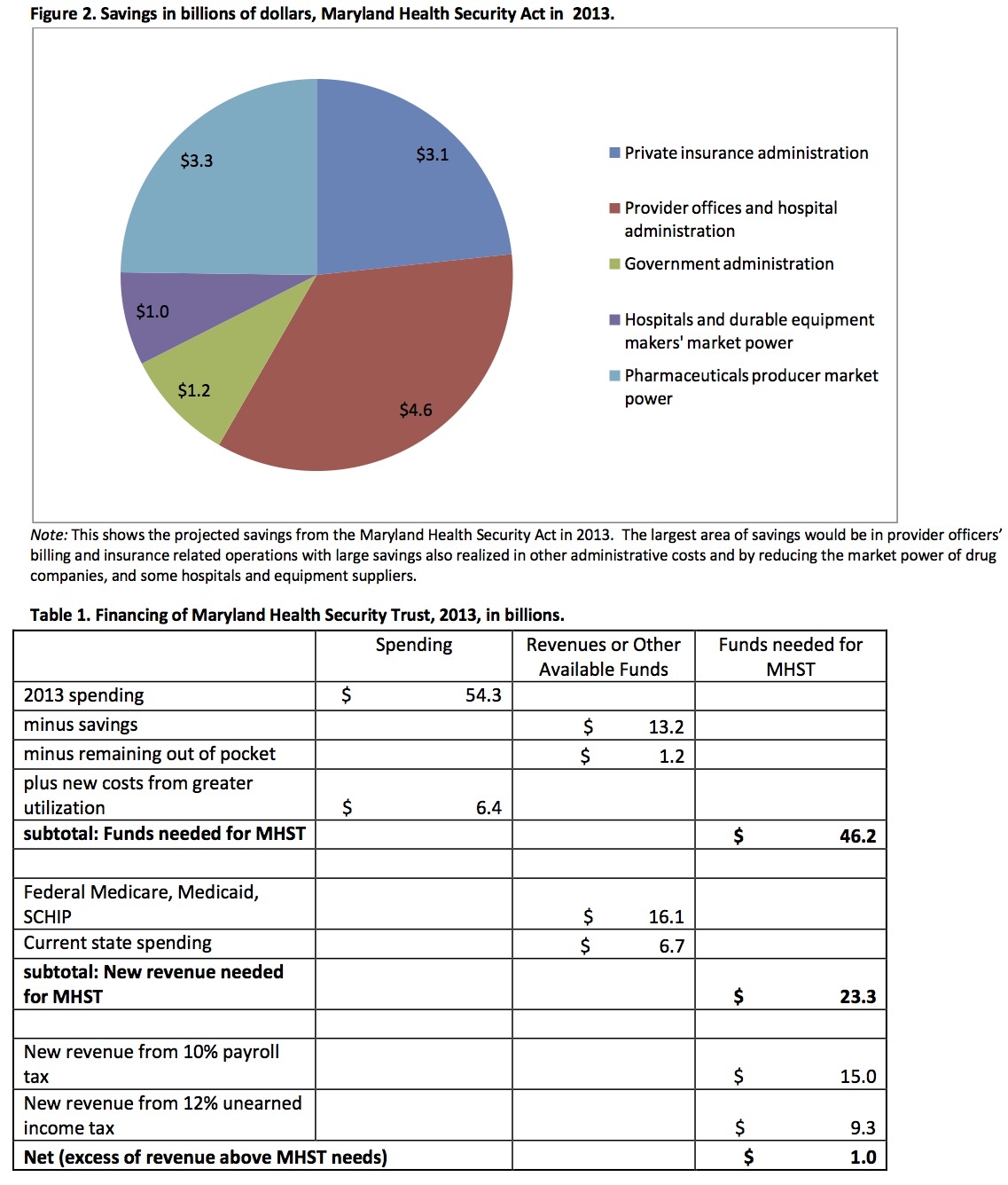

The Maryland Health Security Act (MHSA) would put Maryland on a sustainable path by controlling health care costs while giving all citizens access to quality health care. It would establish the Maryland Health System Trust (MHST) as a single-payer system to finance health care, paying for all necessary medical care including hospital care, visits to doctors, nurses, occupational and physical therapy, prescription drugs, medical devices, medically necessary nursing home care and home health care. By reducing administrative costs and anti- competitive market practices, the MHST could save over $13.2 billion in 2013, or over 24% of existing spending. These savings would allow the expansion of coverage to all Maryland residents while still saving over $6 billion, or over $1,000 per person.

The MHST would be funded by payroll taxes and a levy on non-wage income including capital gains, profits, rents, dividends, and interest. The shift from insurance premiums and out-of-pocket expenses to taxes linked with income would especially benefit lower- and middle-income Marylanders, businesses would also benefit from the reduced administrative burden and because payroll taxes would be less than most now pay in insurance. By lowering payroll costs, the MHST would make Maryland businesses more competitive, producing an additional 70,000 new jobs.

Comments

7 Responses to “Maryland Economic Impact Study by Gerald Friedman, Ph.D.”

This is fantastic! Excellent work!

Highlights:

*70,000 new jobs in 2013

*Median net income would rise by more than 7% in 2013

*$1.5 billion in savings for the federal government, $500 million in savings for the state government, and over $1 billion in savings for local governments in 2013

*In 2023, annual Maryland health expenditures will have plummeted from a projected $114 billion to roughly $82 billion, a savings of $32 billion (28%)

*No co-pays, deductibles, or other out of pocket costs

*Includes Dental

Question: The 10% payroll tax, is all of that 10% on the employer side? Are there any employee side payroll taxes?

The 10 % of payroll tax is paid by – who?

There would be no “Opt-out” provision, correct? Then it would work.

How do you insure the unemployed, self employed, homeless etc.?

How do you get this thru the MD legislature?

Will people on Medicare benefit from this?

I hope they would, because I spend now 20% of my income on healthcare and LTC.

That is an outrage. I lived in Germany – so I know we are in a mess in the USA.

— I am very interested in this proposal!

So, in addition to a question already asked, (The 10% payroll tax, is all of that 10% on the employer side? Are there any employee side payroll taxes ?) I would ask a few more questions :

Have any Maryland legislators agreed to support this initiative ?

Has it been put into the form of a bill that can be introduced in the Maryland legislature ?

Does the Governor of Maryland support this proposal ?

Have any medical associations, or health care provider groups – including physicians, nurses, etc. – shown support for this proposal ?

Harvard surgeon Dr. Atul Gawande is one of the most widely read and respected medical doctors in the U.S. He writes elegantly and with insight on a wide range of topics. However, he likes the “Massachusetts” model and advises Obama, who pretty much adopted that system. Does Gerald Friedman know why Doctor Gawande resists the idea of Single Payer? Dr. Gawande would be a powerful ally and advocate if he were converted.

There are 2 bills:

SENATE BILL 206 (http://mlis.state.md.us/2012rs/billfile/sb0206.htm)

1/20

First Reading Finance

1/27

Hearing 2/22 at 1:00 p.m.

HOUSE BILL 1015

2/10

First Reading Health and Government Operations

2/15

Hearing 2/23 at 1:00 p.m.

3/13

Unfavorable Report by Health and Government Operations Withdrawn

Arthur Milholland, on March 6th, 2012 6:47 pm, wondered “why Doctor Gawande resists the idea of Single Payer.” True, Dr. Gawande seldom gets into the financing of health care, but this passage is an exception:

“In the current health care system, you’re not paid to keep people healthy. If you’re a complex patient with a range of problems, it doesn’t fit into the world [of primary care visits],”

It perfectly describes the reason Healthcare-NOW works to change the current for-profit, private-insurance system—it doesn’t pay to keep people healthy and it therefore is incompatible with good medical practice and public health. It doesn’t encourage the kind of medical practice Dr. Gawande wants:

“a whole team to take you under their wing and see you through this course of illness,… the system as it should be.”

Dr. Gawande, a surgeon, writes and speaks mostly about primary care practice and public health, where the private-insurance system pinches most, and where support for public health care financing is strongest. Instead of asking why Dr. Gawande resists, one might ask why the more-lucrative medical specialties, which fare better under the private-insurance system, resist. The question answers itself.

[…] As Maryland legislators consider a bill that would mandate health care services to be provided to all residents under a single system, we take a look at the economics of single-payer health insurance. Our guest is economist Gerald Friedman, whose study “Funding the Maryland Health Security Act” is available here. […]